can you go to jail for not filing taxes for 5 years

Ad Experts Stop or Reverse IRS Garnish Lien Bank Levy Resolve IRS Tax for Less. The short answer to the question of whether you can go to jail for not paying taxes is yes.

The Consequences Of Not Filing Taxes

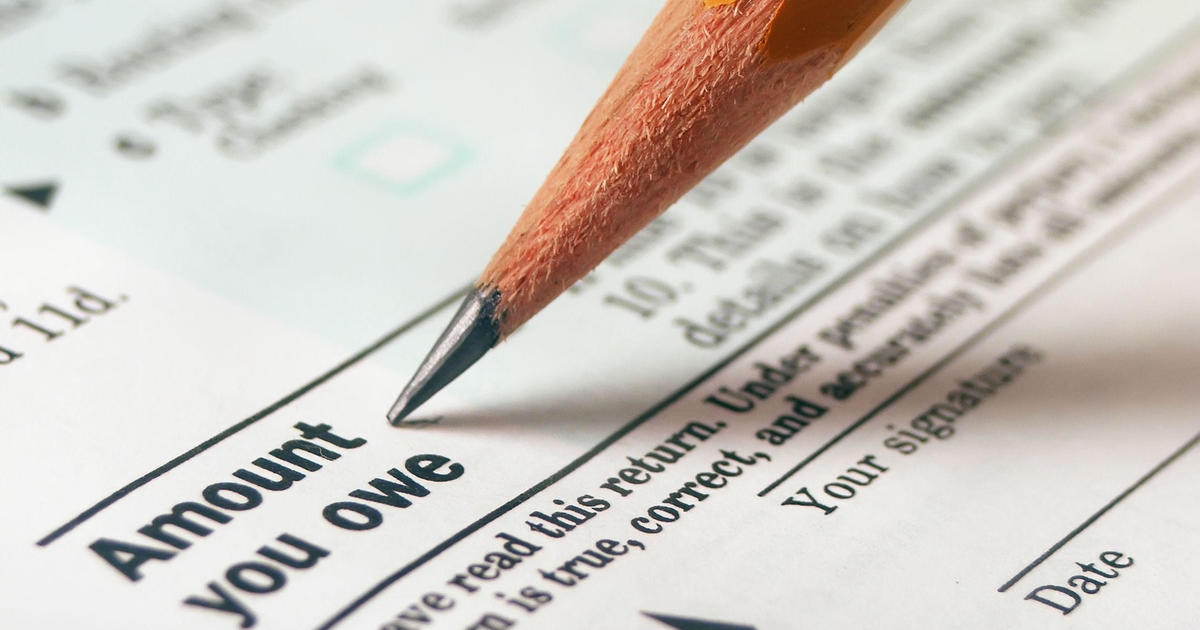

If you file a return late the late-filing penalty is 10 of the tax due or 50 whichever is higher.

. While the IRS can pursue charges against you beginning after that first year you fail to file. If you wish to claim your tax refund you have three years from that years tax return due date to file it. Whether a person would actually go to jail for not.

Beware this can happen to you. It depends on the situation. The average jail time for tax evasion is 3-5 years.

Can a person go to jail for not paying taxes. You can face up to three. The penalty for not filing taxes also known as the failure-to-file penalty or the late-filing penalty usually is 5 of the tax you owe for each month or part of a month your return is late.

The short answer is yes you can go to jail for not paying taxes. In the most serious cases you can even go to jail for up to five years for committing tax evasion. Oftentimes youll be subject to tax penalties.

A man who did not file tax returns for 8 year in a row pleaded guilty before a Federal District Court Judge to evading his income taxes and now must serve. Any action you take to evade an assessment of tax can get one to five years in prisonAnd you can get one year in prison for each year you dont file a return. Evading tax is a serious crime which can result in substantial monetary penalties jail or prison.

Courts will charge you up to 250000 in fines. Will I go to jail for unfiled tax returns. This penalty maxes out.

The criminal penalties include up to one year in prison for each year you failed to file and fines up. Owing back taxes can be the result of failing to file a tax return filing a return but not paying the tax amount you owe or not reporting all income for a specific tax year. Learn more about it here.

If you file but dont pay the late penalty is 1 of the tax due every month. Thats 5 of the balance for every month you dont file. A Texas man was.

If you fail to file a federal tax return by the due date you face a failure-to-file penalty if you owe taxes. People convicted of this crime can expect to pay a. Under federal law you can face up to a year in jail and up to 25000 in fines for not filing your return.

55 56 votes. Ad You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes. The IRS cannot send you to jail or file.

Avoid penalties and interest by getting your taxes forgiven today. If youre required to file a tax return and you dont file you will have committed a crime. For each years portion of your unpaid tax bill the IRS can pursue collection.

A lot of people want to know if you can really go to jail for not paying your taxes. Yes you can go to prison for not paying taxes or filing your tax returns but the circumstances have to be pretty extreme for that to happen. The short answer is maybe it depends on why youre not paying your taxes.

But only if you did so on purpose. In addition to a prison term the US. If you dont file federal taxes youll be slapped with a penalty fine of 5 of your tax debt per month that theyre late capping at 25 in addition to however much money you may.

The penalties are even stricter if you commit fraud. May 4 2022 Tax Compliance.

What Happens If You File Taxes Late

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

What Happens If You Don T File Taxes Can You Go To Jail For Not Filing Taxes Parade Entertainment Recipes Health Life Holidays

Can I Go To Jail For Unfiled Taxes

What Is The Penalty For Not Filing Taxes Forbes Advisor

What Happens If You File Taxes Late

Penalties For Claiming False Deductions Community Tax

Can You Go To Jail For Not Paying Taxes

Who Goes To Prison For Tax Evasion H R Block

What Really Happens When I Don T File For My Tax Return Incometax Tax Taxseason Money Finance Irs Taxevasion Income Tax Tax Return Taxact

I Forgot To File My Taxes Now What Community Tax

What Are The Irs Penalties And Interest For Filing Taxes Late Cbs News

What To Do If You Did Not File Taxes How To Avoid Major Penalties

We Ran Our Taxes Through 5 Different Software Programs

Is It Illegal Not To File Your Taxes If So Why Taxrise Com

How To Get Maximum Tax Refund If You File Taxes Yourself Parade Entertainment Recipes Health Life Holidays

Is Jail A Possibility If You Fail To Pay Your Taxes Frost Law Maryland Tax Lawyer

Knock Knock It S The Irs Time To Pay The Piper Can You Help Me Knock Knock Sayings

It S Been A Few Years Since I Filed A Tax Return Should I Start Filing Again H R Block